IRS Code Section 179 is a bird in the hand until December 31, 2017.

Update: The passage of The Tax Cuts and Jobs Act (H.R.1 - 115th Congress) increased the deduction limit for Section 179 from $500,000 to $1,000,000 for 2018 and beyond. The equipment purchase limits have also increased from $2 million to $2.5 million. For full details of these changes and how they will affect businesses, go to http://www.section179.org/.

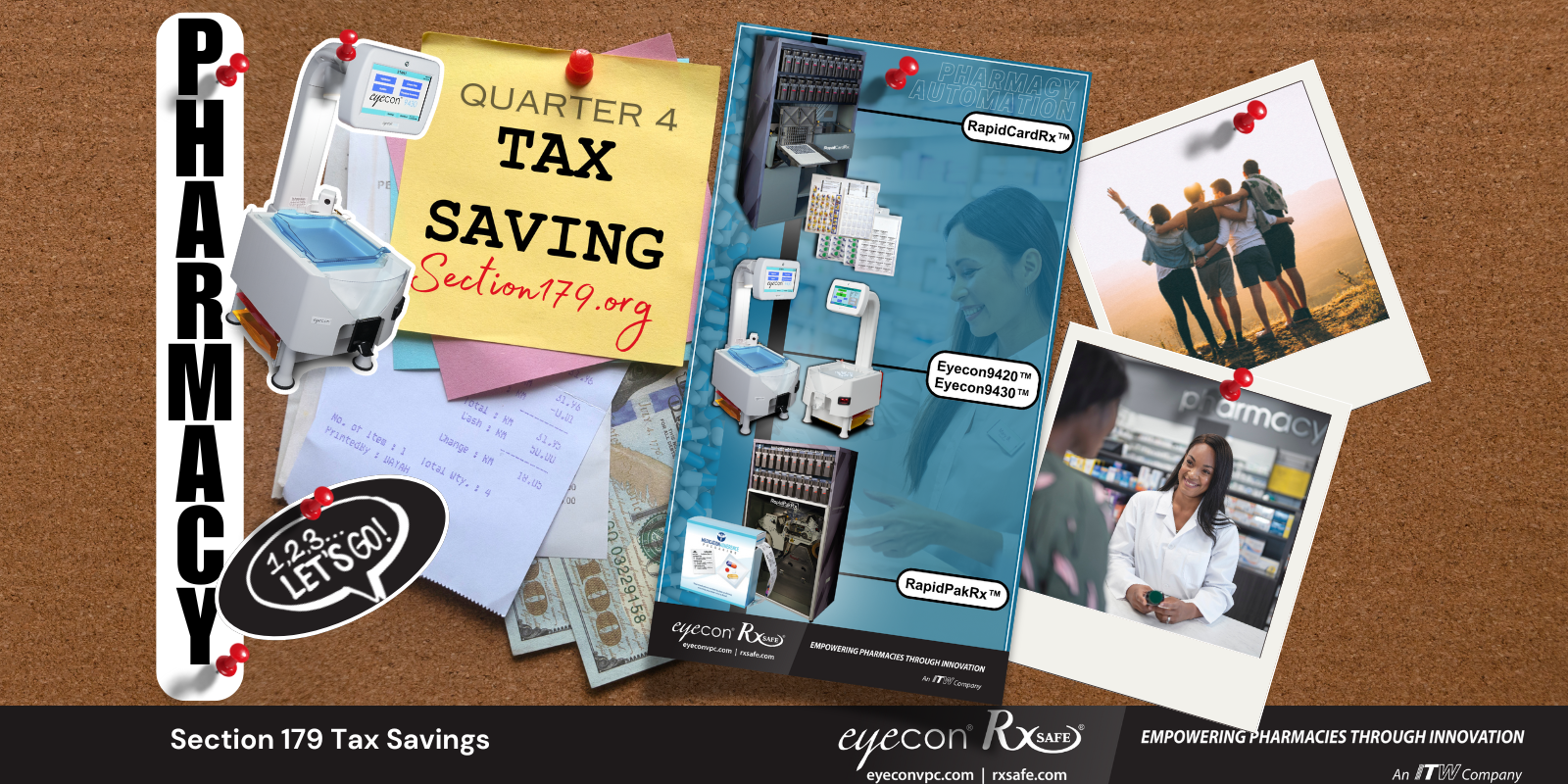

Section 179 of the federal tax code is pretty simple, actually. At this point in time, businesses may deduct the full purchase price of qualifying equipment – and yes, RxSafe systems such as the RxSafe 1800 qualify – during the tax year of purchase, finance, or lease. In other words, independent pharmacy owners who act before Dec. 31, 2017 can deduct the full purchase price of pharmacy equipment (up to $500,000) from their gross income. This is a major incentive to encourage pharmacies to buy equipment and invest in their businesses – and our customers, such as independent pharmacy owner Kevin Reddish of Reddish Pharmacy, have already used Section 179 advantageously!

At RxSafe, we provide our customers and potential customers with a wealth of information about how Section 179 can be used to put money right back into their cash registers – almost immediately. Click here to read more, watch informative videos (such as the video featuring pharmacy owner Kevin Reddish), or try out our Section 179 Calculator to see how the tax code section can work for you.

What will happen with Section 179 in 2018 and beyond?

The short answer: Who knows?

Could the Section 179 tax deduction go away in 2018? Will the deduction or requirements be modified? Are pharmacies purchasing capital equipment going to be profitable without it – or as profitable with some other version of it?

There is a fair amount of uncertainty being discussed by financial and tax experts concerning President Trump’s budget plan and proposed tax plan being considered by Congress.

Obviously, no one knows for certain if IRS Tax Code Section 179 deduction will disappear, but it could be at risk.

According to an article posted on Inc.com on August 29, 2017 the future of the Section 179 deduction is uncertain.

“Currently, many small businesses can qualify for accelerated depreciation on certain capital expenditures, which can result in significant tax benefits. Remember, depreciation is an expense on your income statement--which, in the case of Section 179 items, can significantly reduce the taxes you owe. The potential phase-out of this deduction could have a large impact on small business investment, and the taxes you're paying.”

Why wait?

Whether there is downside such as a phase-out of the deduction, or upside, such as a possible increase in the deductible amount, there’s no reason to wait. The many advantages of owning RxSafe’s innovative pharmacy automation equipment AND the benefits of the IRS Code Section 179 deduction can be locked in right now.

Peter Davison and his team at Advantage Financial Services have been working with RxSafe and independent pharmacy owners since 2012. Peter is featured on video explaining how Section 179 and the RxSafe 1800 work together to put profit back in the pockets of pharmacy owners. Here is one “simple math” example from the video:

“Potentially if you’re investing in an RxSafe at $116,000 to $204,000, somewhat in that neighborhood, and you’re in a tax bracket of 20 to 35%, that 20 to 35% can come right off your taxes in April as an accelerated depreciation benefit. Additionally that may impact you on your quarterly estimates for the following year. If you take just some simple math on a 2-Tower RxSafe system at a 25% tax bracket, $200,000 in expense would equate back out to approximately $50,000 in tax savings come April. That’s significant cash flow. What’s nice about that is, if you’re using an equipment lease or financing agreement, you may actually be cash-flow positive just from that experience itself.”

Why not call now – 877-797-2332 – to explore two important steps to higher profits for your independent pharmacy? We will help you determine what technology may be right for your pharmacy and learn how to put IRS Code Section 179 to work before December 31, 2017.

.png)