Even though it’s only August, it’s never too early to start planning for end-of-year savings. As the year draws to a close, pharmacies are exploring ways to enhance efficiency and drive profitability. One of the most effective strategies you can adopt right now is leveraging Section 179 of the IRS tax code. If you're looking to upgrade your pharmacy with cutting-edge automation technology, RxSafe and Eyecon are the perfect solutions to enhance efficiency and drive profitability, and they may also qualify for this valuable tax deduction.

What is Section 179?

Section 179 allows businesses to deduct up to the full purchase price of qualifying equipment and software purchased or financed during the tax year. Instead of writing off depreciation over several years, Section 179 lets you take the full deduction for this year —putting cash back into your business faster. For pharmacies, this means significant savings on your income tax for 2024 and future estimates for 2025, especially when investing in high-quality, high-impact equipment like RxSafe and Eyecon.

Why Choose RxSafe and Eyecon?

RxSafe and Eyecon offer unparalleled benefits for pharmacies looking to improve accuracy, efficiency, and overall workflow.

-

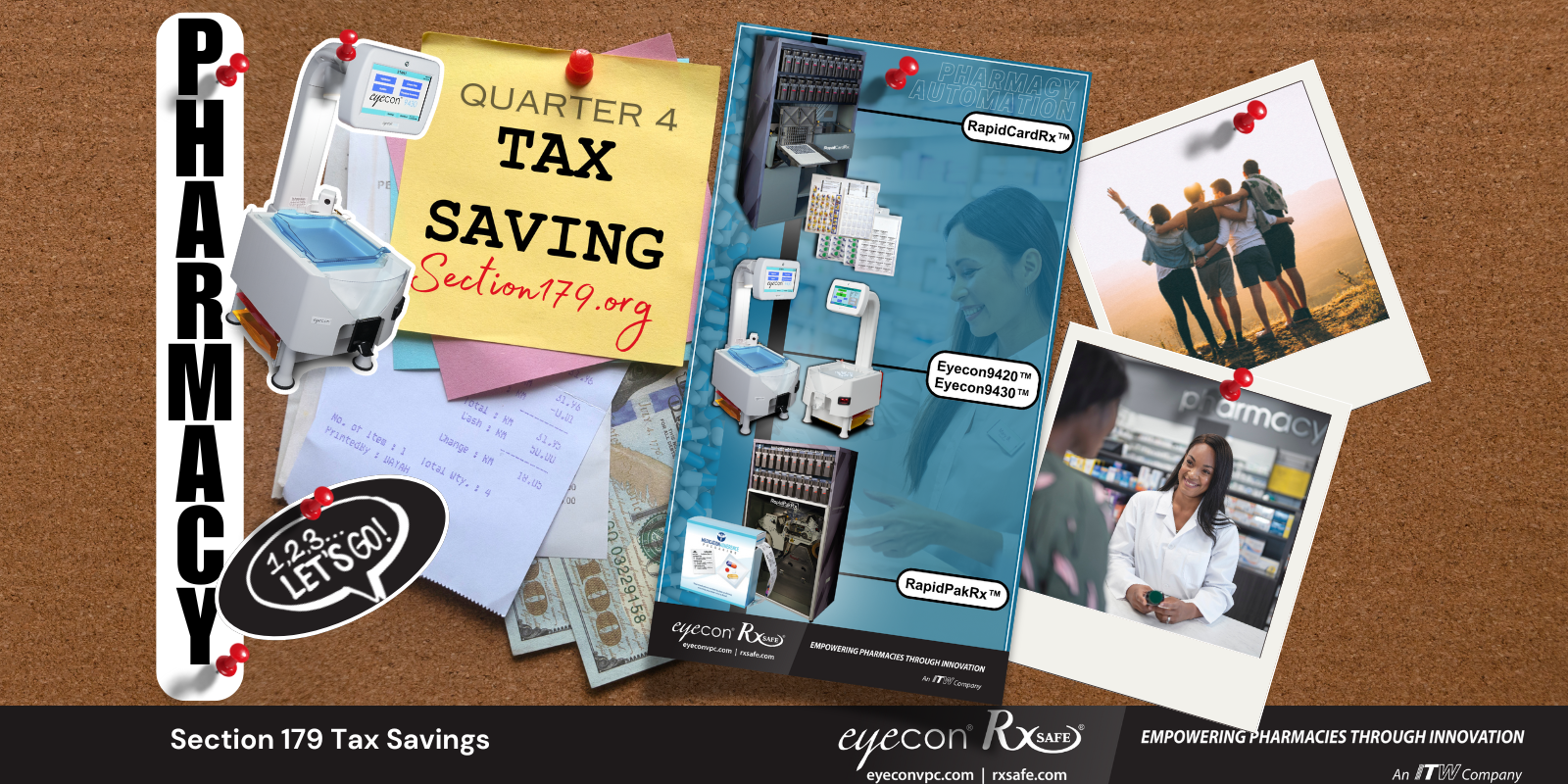

RxSafe: Known for its innovative automation systems, RxSafe provides cutting-edge technology in a small footprint with each solution they offer. RapidPak delivers extremely accurate pouch packaging due to its three step vision verification process with built in final inspection. RapidCard simplifies multi-med blister card fulfillment, drastically reducing the potential for human error while increasing throughput. The RxSafe 1800 automates stock bottle storage and retrieval while providing inventory security, space savings and maintaining a perpetual inventory.

- Eyecon: Eyecon’s Visual Precision Counting technology revolutionizes pill counting with accuracy and speed, minimizing the risk of miscounts and ensuring compliance with strict pharmacy regulations. When connected to a PMS, Eyecon can automatically send pill count data, update inventory records, and sync with patient prescription information. It can also track and manage inventory by integrating pill counting with real-time inventory data.

Both technologies not only enhance operational efficiency but also contribute to better patient outcomes—a core goal for any pharmacy.

How Section 179 Works with RxSafe and Eyecon.

When you invest in RxSafe or Eyecon equipment, you may be able to deduct the full purchase price from your gross income under Section 179. This deduction is a game-changer for pharmacies of all sizes, as you could say it effectively reduces overall cost of your investment while allowing you to benefit from state-of-the-art technology.

For instance, if you purchase a system valued at $100,000, Section 179 lets you deduct the entire amount from your taxable income. This could translate to significant tax savings, freeing up capital for other critical areas of your business.

Estimate Your Savings with the Section 179 Calculator.

To see exactly how much you can save, use the Section 179 Calculator. This tool allows you to input the purchase price of your equipment and instantly calculate the potential tax savings for your pharmacy. By understanding the financial impact beforehand, you can make informed decisions that align with your business goals.

Don’t Wait—Act Now!

The opportunity to maximize your savings with Section 179 is time-sensitive. With the end of the tax year approaching, now is the perfect time to invest in RxSafe and Eyecon. By doing so, you'll not only enhance your pharmacy's operations but also ensure you're getting the most out of your tax deductions. Check with your accountant as to how Section 179 could help you and your business.

Ready to make a smart investment? Reach out today to learn more about how RxSafe and Eyecon can transform your pharmacy, and how you can benefit from Section 179 before the year ends.

.png)