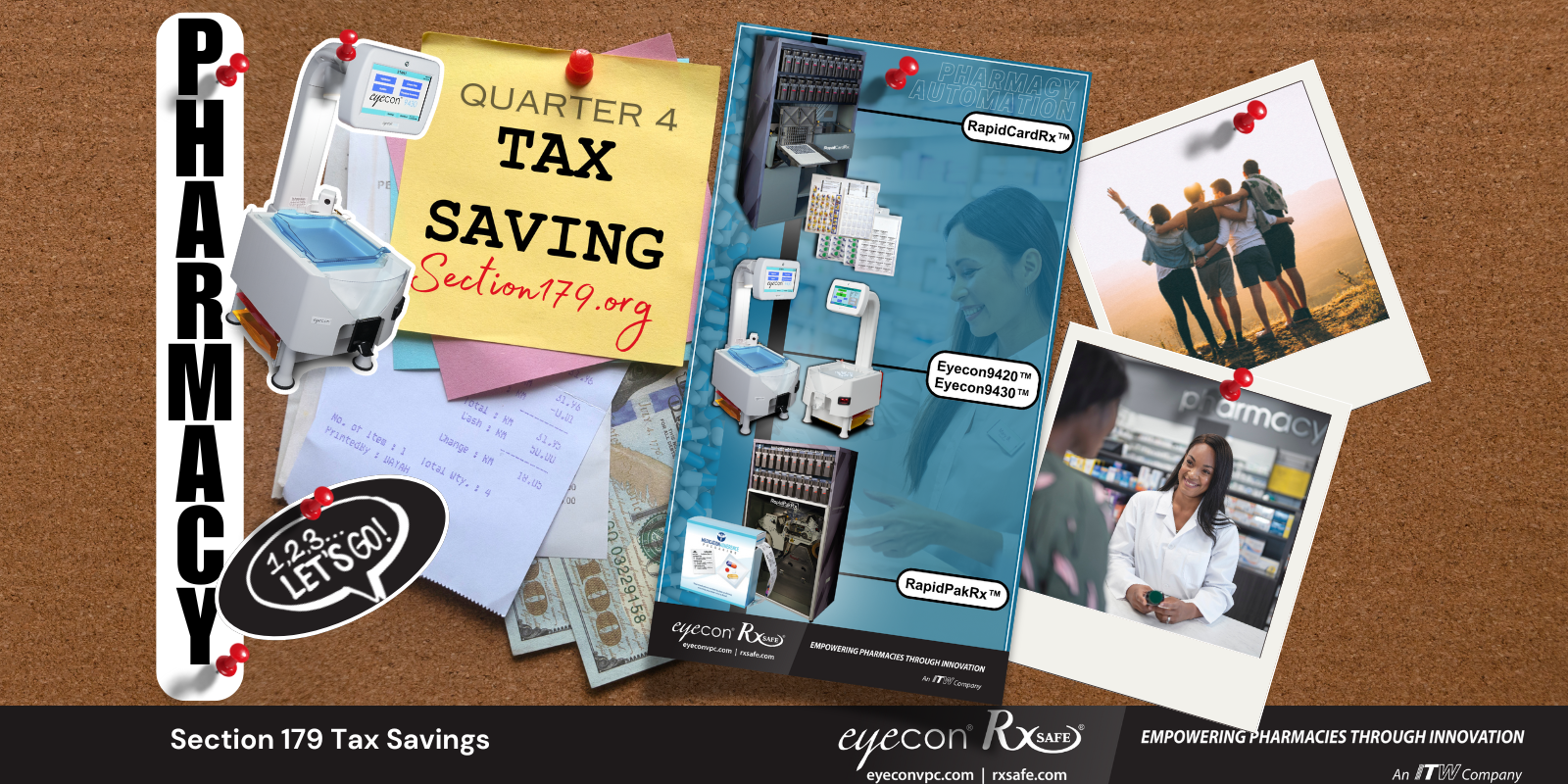

Even though it’s only August, it’s never too early to start planning for end-of-year savings. As the year draws to a close, pharmacies are exploring ways…

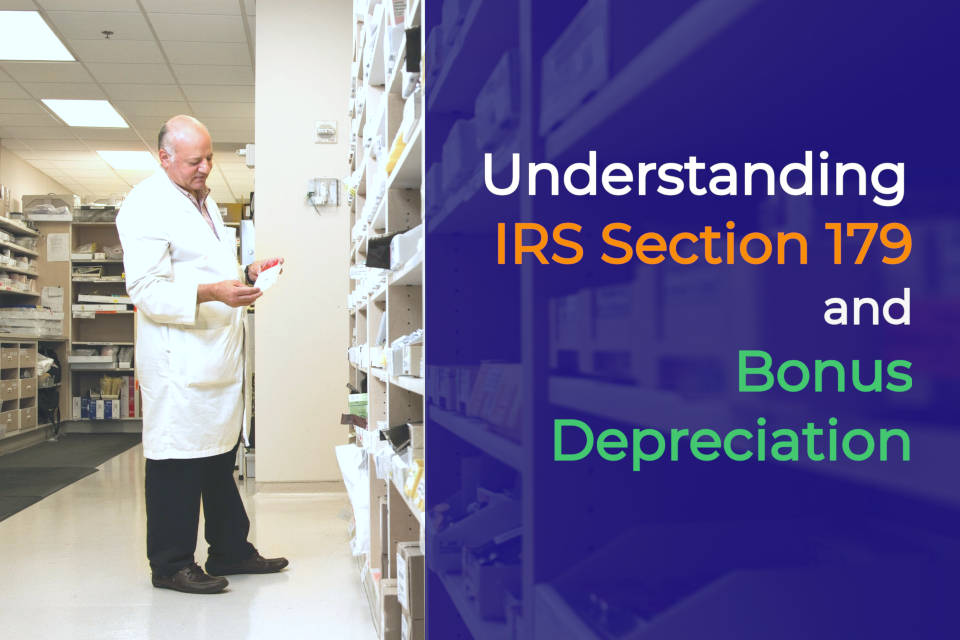

Readers of this blog know that Internal Revenue Service (IRS) Section 179 can save pharmacy owners from owing a large sum to Uncle Sam next year, if they…

IRS Section 179 is especially appealing for small businesses such as independent pharmacies, as it allows pharmacy owners to deduct the full purchase…

Savvy pharmacy owners know that Internal Revenue Service (IRS) Section 179 can save them from writing a huge check to Uncle Sam next year, if they invest…

As the end of the 4th quarter approaches, businesses are looking to finish the year strong. Pharmacy financial expert Pete Davison of Advantage Financial…

Independent pharmacy owners are using Section 179 to invest in automation, like the RapidPakRx, to grow their business. Shane Becker, owner of Old Town…

As we quickly approach the end of this year, we know some independent pharmacists are hesitant to invest in automation. Not only are pharmacists facing…

.png)