As we quickly approach the end of this year, we know some independent pharmacists are hesitant to invest in automation. Not only are pharmacists facing low reimbursements and increasing DIR fees, but they are also facing new challenges due to the pandemic. (Hey, we get it!)

Despite these challenges, automation can still be attainable for independent pharmacy owners.

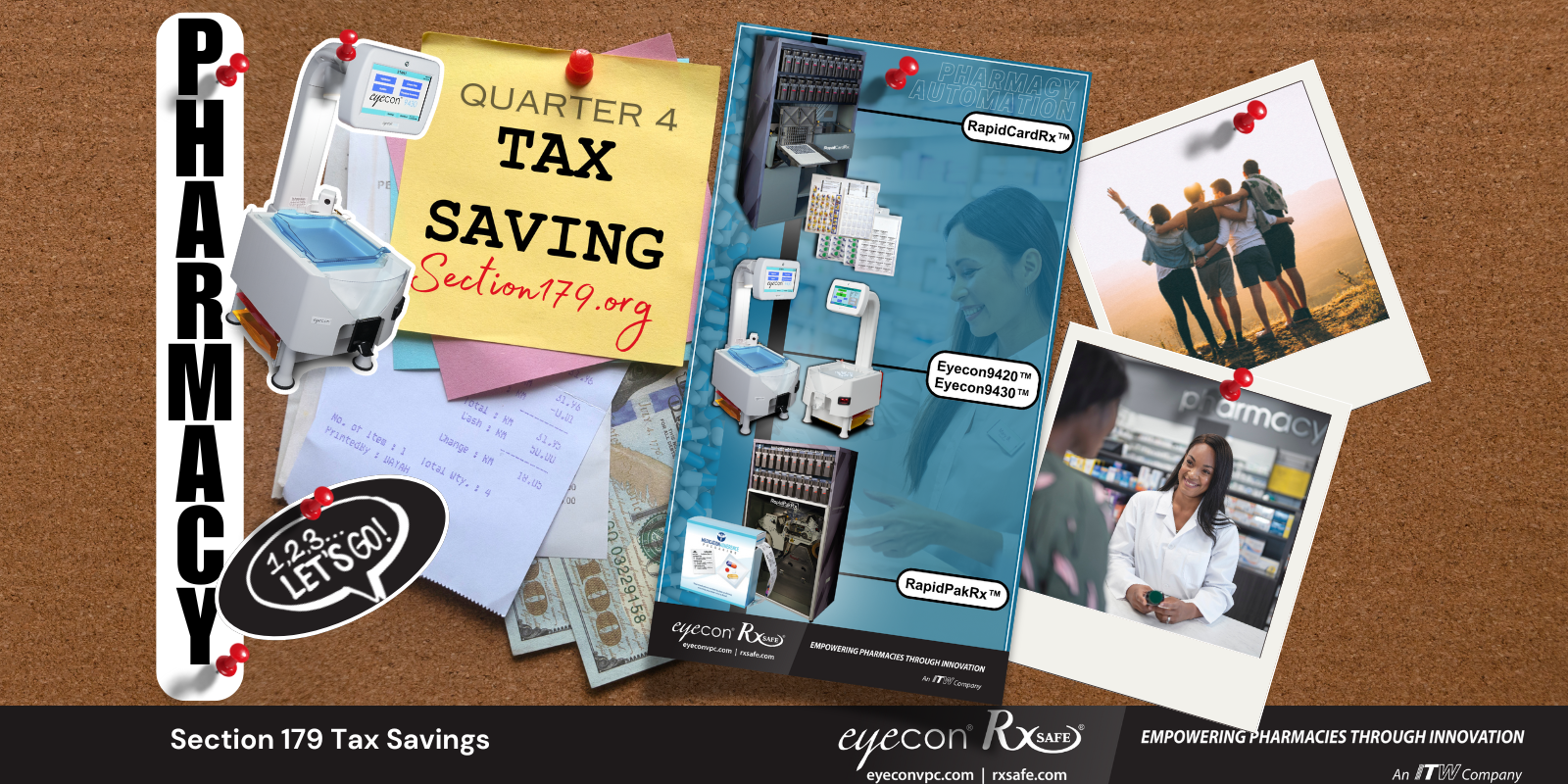

The Section 179 deduction was designed to help small business owners offset the cost of purchasing new equipment. In this post, we will address some of the most frequently asked questions regarding Section 179 tax savings, with the help of Ollin Sykes, CPA and president of Sykes & Company.

How Does Section 179 Benefit Pharmacy Owners?

Click above to watch the full video.

“Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service,” says Sykes. This means that pharmacists can deduct the the full purchase price of qualifying equipment.

“It applies to tangible personal property, such as machinery and equipment purchased for use in a trade or business,” adds Sykes. An example of qualifying pharmacy equipment is the RapidPakRx, an adherence pouch packaging system.

As Sykes stated, it is important to note that Section 179 becomes applicable once the equipment is placed into service. So if your equipment was purchased in 2019, but was actually put into service in 2020, then your equipment would become eligible this tax season.

Consulting with a professional can assess your personal tax situation and can help you decide how Section 179 could make the RxSafe 1800 or RapidPakRx more affordable for your pharmacy.

Are there any changes for 2020?

“There is a limit on the amount of depreciation of Section 179 that can be taken, which this year inflation adjusted to $1,040,000,” says Sykes. This is the only adjustment that has been made for 2020.

There are no foreseeable changes in the near future, so pharmacy owners should not expect any surprises.

“We're in the political season and depending on the political outcome it could change, but as it is currently scheduled right now it is in the law of a permanent basis,” says Sykes.

Watch Scotty Sykes, from Sykes & Company, explain the most important thing pharmacy owners need to know in 2020.

Ready to Take Advantage of Section 179?

If you want to take the next steps and grow your business, Section 179 can help your pharmacy obtain the necessary equipment to grow. It is important to start planning for your new equipment, and understand where your pharmacy stands financially.

“The key thing here is pharmacies need to know where they stand on a full accrual basis,” says Sykes. “Pharmacies need to understand each and every month, what money it is they're making or not making, and the only way they can determine that is on a full accrual basis, adjusting cash, receivables, inventory, payables each and every month.”

Talking with your accountant can help your business plan for the investment. Click here to learn more about Section 179. If you have any questions about the RxSafe 1800 or the RapidPakRx, please call (877) 797-2332 to speak to one of our automation experts.

.png)