Since the landmark victory for independent pharmacies in Rutledge v. PCMA in 2020, dozens of states have joined Arkansas in forging legislation to fight back against draconian billing practices by pharmacy benefits managers (PBMs). The Rutledge decision provided a “roadmap” to states as to how PBMs may (and may not) be regulated, and has resulted in more state laws that regulate PBMs. You can read about the Rutledge case here.

In 2021 alone, 18 states passed a PBM licensing/registration requirement or had one that became law in 2021. In 2022, we continue to see a huge amount of activity by states to rein in PBMs. All told, more than 45 states have passed laws regulating PBMs.

Common characteristics of state-level PBM regulation include: pharmacy auditing standards, bans on clawbacks and spread pricing, transparency on drug/consumer costs, fiduciary requirements, licensing/registration requirements, prohibitions on patient steering, adequacy of pharmacy networks, reimbursement/price transparency, and requirements to pass drug rebates on to patients.

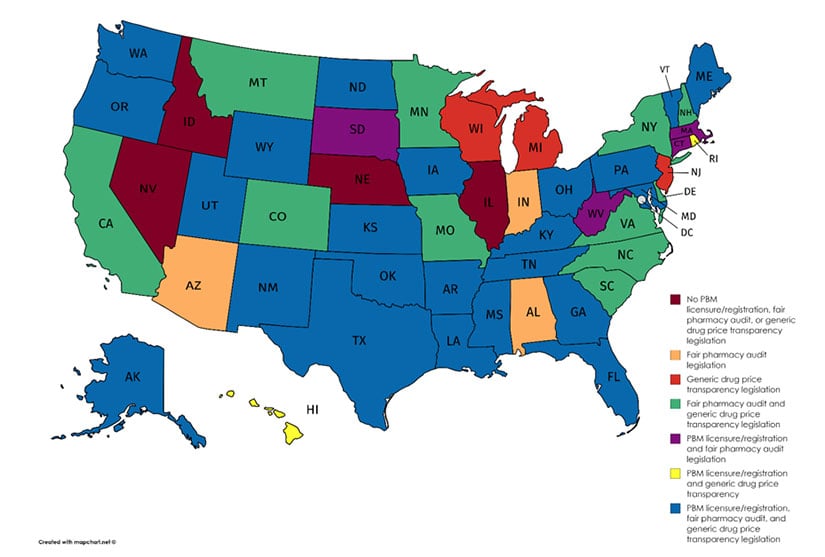

PBM reform map by state. (Image courtesy of NCPA)

RxSafe combed the web to provide an update on all the latest legislation – both enacted and in progress – to help curb PBM abuse at the state level. Thanks to our friends at the National Conference of State Legislatures and the National Law Review for doing the “heavy lifting” on research, and to the American Pharmacists Association (APhA), National Community Pharmacists Association (NCPA) for their efforts to help independent pharmacies increase drug price transparency and hold PBMs accountable for driving up the cost of prescription drugs to the detriment of patients.

Below is an alphabetical list of states, along with recent bills, laws and their statuses.

| State | Bill/Law | Status |

| California | S 939 would prohibit a PBM from discriminating against a covered entity or its pharmacy in connection with dispensing a drug subject to federal pricing requirements or preventing a covered entity from retaining the benefit of discounted pricing for those drugs. CA A 2352 would amend pharmacist gag clauses, requiring health plans that provide prescription drug benefits and maintain one or more drug formularies to furnish, in real time, specified information about a prescription drug upon request by an enrollee or insured, or their health care provider. CA A 2942 would require an insured's defined cost sharing for each prescription drug to be calculated at the point of sale based on a price that is reduced by an amount equal to 90% of all rebates received in connection with the dispensing or administration of the drug. The bill would require a health plan to, among other things, pass through to each enrollee or insured at the point of sale a good faith estimate of their decrease in cost sharing. The bill would require a plan to calculate an enrollee's or insured's defined cost sharing and provide that information to the dispensing pharmacy. |

S 939 – Pending, Assembly Health Committee. A 2352 – Pending, Senate Third Reading. A 2942 – Pending, Assembly Health Committee. |

|

Colorado |

HB 1370 prohibits PBMs from modifying a current prescription drug formulary during the current plan year, and requires health plans and PBMs to use 100% of estimated rebates received to reduce policyholder costs. |

Law takes effect 1/1/2024. |

|

Illinois |

S 3924 prohibits health plans or PBMs from require an enrollee to obtain a covered clinician-administered drug from a pharmacy selected by the health benefit plan or pharmacy benefit manager with the intent to transport the drug to another site of service for administration, (2) require an enrollee to obtain a covered clinician-administered drug from a pharmacy selected by the health benefit plan or pharmacy benefit manager, (3) notwithstanding any other provision of law, steer or offer financial or other incentives to induce an enrollee to obtain a clinician-administered drug from a pharmacy identified by the health benefit plan or pharmacy benefit manager, (4) condition, deny, restrict, refuse to authorize, or otherwise limit benefits and coverage to an enrollee for medically necessary clinician-administered drugs and related services obtained from the provider that administers the drug or from a pharmacy that is not selected by the health benefit plan or pharmacy benefit manager, (5) condition, deny, restrict, refuse to authorize, or otherwise limit reimbursement to a provider for covered medically necessary clinician-administered drugs and related services obtained from the provider that administers the drug or from a pharmacy that is not selected by the health benefit plan or pharmacy benefit manager, (6) assess higher deductibles, copayments, coinsurance, or other cost-sharing amounts for clinician-administered drugs obtained from the provider that administers the drug or from a pharmacy that is not selected by the health benefit plan or pharmacy benefit manager, (7) require an enrollee to use a home infusion pharmacy to receive clinician-administered drugs in their home or to use a site of service identified by the health benefit plan or pharmacy benefit manager, or (8) include the site of service in prior approval or medical necessity criteria for clinician-administered drugs. (c) A clinician-administered drug shall meet the supply chain security controls and chain of distribution set by the federal Drug Supply Chain Security Act. |

Pending, Senate Committee on Assignments Committee. |

|

Florida |

HB 357 revises and clarifies requirements and restrictions that apply to health plans and PBMs that audit pharmacy records, and imposes a $10,000 (per violation) penalty for not registering as a PBM. |

Law took effect 7/1/22. |

|

Michigan |

Three new prescription drug laws aim to control drug costs by regulating PBMs that provide services on behalf of group health plans to Michigan residents. The trio of laws address licensing, transparency, network adequacy, spread pricing, medication limits, affiliated pharmacy preferences and disclosures between a pharmacy and a participant. Act 11, HB 4348, sets out parameters for PBM licensing and regulates PBM practices and contracts with pharmacies. Act 12, HB 4351, amends Michigan’s Third Party Administrator (TPA) Act to include PBMs in the definition of a TPA. Act 13, HB 4352, amends the state’s Public Health Code to require certain pharmacy disclosures. S 1088 relates to TPAs and modifies restrictions relating to a PBM’s interaction with a 340B program entity. |

Act 11, HB 4348 – takes effect 1/1/24. Act 12, HB 4351 – took effect 2/23/22. Act 13, HB 4352 – took effect 2/23/22. S 1088 – pending Senate Health Policy and Human Services Committee. |

|

Nebraska |

LB 767 sets forth standards and criteria for the licensure and regulation of PBMs operating in the state, requiring PBMs to be licensed prior to conducting operations, specifying certain contractual terms that can or cannot be in agreements, and imposing requirements and limitations on PBMs and their third-party auditors when conducting pharmacy or pharmacist audits. |

Law takes effect 1/1/23. |

|

New Jersey |

A 536 provides for the licensure of PBMs. Under the bill, the Commissioner of Banking and Insurance is to create the application for a license to operate in this State as a PBM and may charge application fees and renewal fees. The commissioner is also to establish the licensing, fees, application, financial standards, and reporting requirements of PBMs. The bill provides that, in any participation contracts between PBMs and pharmacists or pharmacies providing prescription drug coverage for health benefit plans, no pharmacy or pharmacist may be prohibited, restricted, or penalized in any way from disclosing to any covered person any health care information that the pharmacy or pharmacist deems appropriate regarding the nature of treatment, risks, or alternatives thereto, the availability of alternate therapies, consultations, or tests, the decision of utilization reviewers or similar persons to authorize or deny services, the process that is used to authorize or deny health care services or benefits, or information on financial incentives and structures used by the insurer. Bill A 554 prohibits pharmacy benefits managers from requiring covered persons to use mail order pharmacies. |

A 536 – Pending, Assembly Appropriations Committee A 554 – Pending, Assembly Financial Institutions and Insurance Committee |

|

New York |

S 8838 establishes that a PBM has a fiduciary duty to consumers. |

Pending, Assembly. |

|

Ohio |

H 655 defines "affiliated pharmacy" as a pharmacy in which a health plan issuer, either directly or indirectly through one or more intermediaries, has an investment or ownership interest or with which it shares common ownership. A health plan or PBM shall not do any of the following: (1) Order or direct a covered person to fill a prescription at or obtain services from an affiliated pharmacy, (2) Restrict a covered person's ability to select a pharmacy if the selected pharmacy is in the health plan issuer's pharmacy provider network, (3) Impose a cost-sharing requirement on the covered person that differs depending on which in-network pharmacy the covered person uses, (4) Impose any other condition on a covered person or pharmacy that restricts a covered person's ability to use an in-network pharmacy of the covered person's choosing, (5) Prevent a pharmacy from participating in the health plan issuer's network if the pharmacy meets both of the following criteria: (a) The pharmacy is willing to agree to the terms and conditions of the health plan issuer's pharmacy provider contract. (b) The pharmacy provides pharmacy services in accordance with all applicable state and federal laws. (6) Require a pharmacy, as a condition of participation in the health plan issuer's network, to meet accreditation standards or certification requirements that are inconsistent with or in addition to those of the state board of pharmacy, (7) Transfer or share records relating to prescription information containing patient-identifiable or prescriber-identifiable data to or with an affiliated pharmacy for any commercial purpose. Division (B)(7) of this section shall not be construed to prohibit the exchange of prescription information between a health plan issuer and an affiliated pharmacy for the limited purposes of pharmacy reimbursement, formulary compliance, pharmacy care, or utilization review. (8) Knowingly make a misrepresentation to a covered person, pharmacist, pharmacy, or dispensing physician. |

Pending, House Health Committee. |

|

Oklahoma |

SB 737 amends existing state statutes to prohibit PBMs from using spread pricing, restricts fees that PBMs can charge to pharmacists or pharmacies; and imposes new reporting requirements on PBMs, which require disclosures to both PBM clients and the Oklahoma Insurance Commissioner. |

Took effect 4/21/22. |

|

Tennessee |

HB 2661 prohibits PBMs from reimbursing their contracted pharmacies for any amounts less than the actual cost of the drug to the applicable contracted pharmacy, mandates that PBMs operating in the state establish reimbursement appeals processes that must be approved by the state’s commissioner of commerce and insurance, prohibits PBMs from interfering with a patient’s right to choose a contracted pharmacy or provider, and sets forth additional requirements and restrictions that apply to PBMs establishing pharmacy networks.

|

Takes effect 1/1/23 |

|

Vermont |

HB 353 establishes that PBMs owe a fiduciary duty to their health insurer clients and prohibits certain provisions in contracts between PBMs and health insurers, expands prohibitions on “gag clauses” in PBM contracts with pharmacies and pharmacists; and mandates that PBMs allow pharmacies certain appeal rights and provides additional rights to pharmacies during a PBM audit. HB 353 also prohibits PBMs from reimbursing pharmacies less than they would reimburse their affiliates for the same services, prohibits PBMs from interfering with a patient’s right to choose a pharmacy of their choice (i.e. PBM cannot require patients to use of mail-order or affiliate pharmacies), and prohibits PBMs from having network requirements that are more restrictive than (or inconsistent with) state or federal law or that would prohibit a pharmacy or pharmacist from dispensing or prescribing certain drugs. |

Takes effect 1/1/23. |

|

West Virginia |

HB 4112: imposes new state requirements on PBMs, including, among other things, (1) licensure of PBMs, (2) prohibition on PBMs from penalizing for providing information related to lower cost alternatives and cost share, (3) a prohibition on PBMs from reimbursing pharmacies or pharmacists in an amount less than the amount they would reimburse themselves or an affiliate, and (4) a maximum allowable cost methodology reporting requirement, which must be submitted in connection with a PBM’s initial application for licensure |

Took effect 6/10/22. |

At the federal level, NCPA reports that the Senate Commerce Committee recently passed S. 4293, The Pharmacy Benefit Manager Transparency Act of 2022. The bipartisan legislation, introduced by Sens. Maria Cantwell (D-Wash.) and Chuck Grassley (R-Iowa), aims to:

- Prohibit deceptive, unfair pricing schemes, including spread pricing and arbitrary clawbacks of payments made to pharmacies.

- Incentivize transparent PBM practices by making clear that a PBM would not be in violation of the law if it:

- Passes along 100 percent of rebates to health plan sponsor; AND

- Provides full disclosure of cost, price, reimbursement and all charged fees, markups, and discounts to plan sponsor and pharmacy; or

- Provides the aggregate remuneration fees it receives from drug makers to health plans, payers, and any federal agency

- Mandates transparency by requiring PBMs to file an annual report with the Federal Trade Commission (FTC), including the total amount they pocket through spread pricing and pharmacy fees.

- Empowers the FTC and state attorneys general to penalize and/or initiate legal action against PBMs for engaging in prohibited acts in violation of this law.

Is your state’s recent legislation not featured above? Please comment below to let us know and we’ll update the list ASAP! Thanks for reading.

.png)