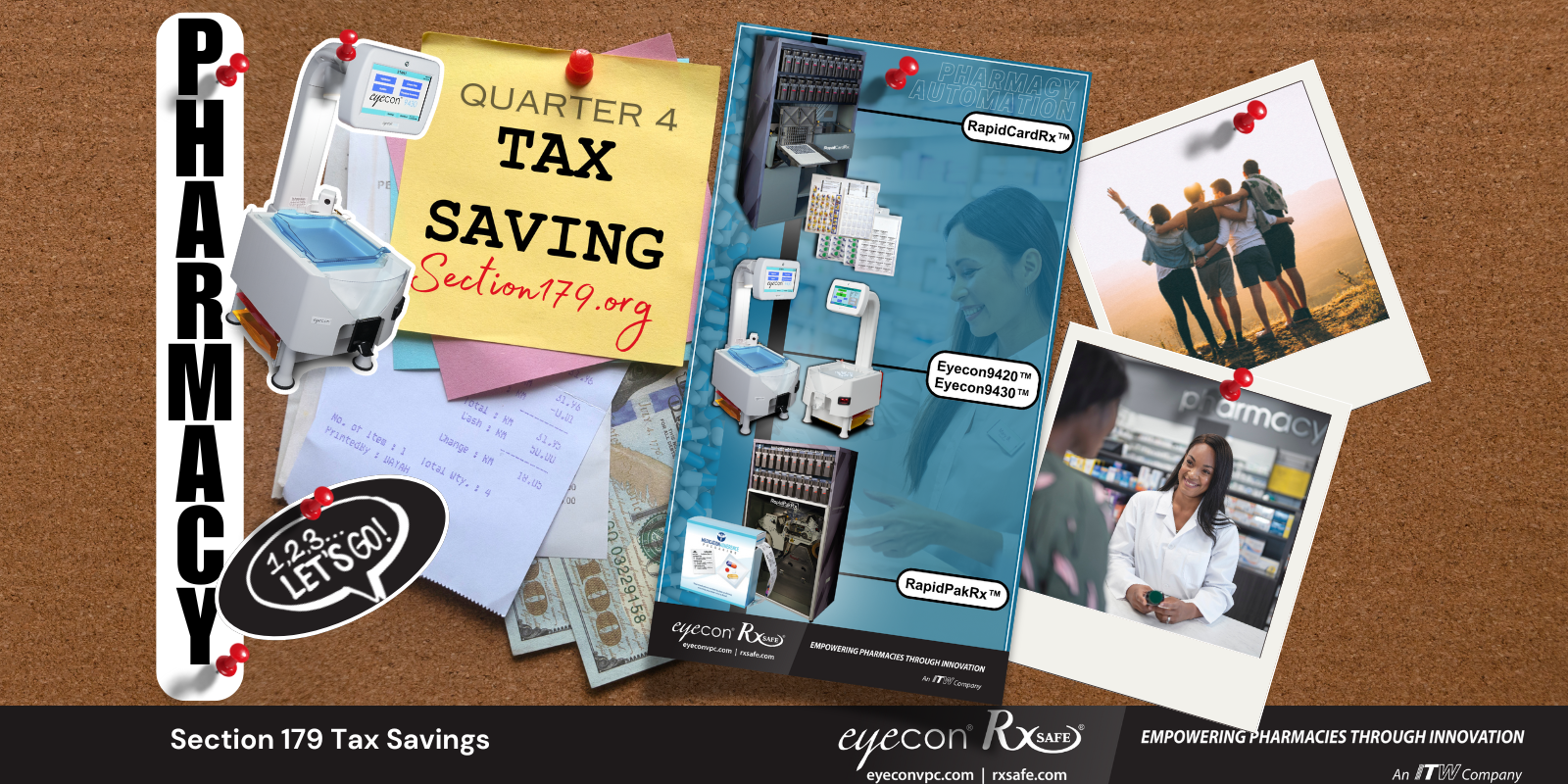

Independent pharmacy owners are using Section 179 to invest in automation, like the RapidPakRx, to grow their business. Shane Becker, owner of Old Town Pharmacy in Monett, Missouri, has personally used the tax break to invest in automation that has helped him grow his business.

With multiple pharmacy locations, Becker understands how Section 179 can benefit independent pharmacy owners. Listen to Becker share his experience using Section 179 to invest in the RapidPakRx below.

Communication is Key

Becker believes it is important to communicate your financial situation with your accountant - but also good practice to discuss your pharmacy needs with your sales representative. “It becomes important that you are explaining to whoever you're purchasing from, that you want this set up for Sec 179,” says Becker.

“RxSafe has done a great job with that in the past, as they're very knowledgeable to work with,” adds Becker. "The RapidPakRx system did allow us to take advantage of Section 179 tax benefits, which made my taxes almost zero that year."

After purchasing his first RapidPakRx, Becker is now looking to add a second unit to a new location -- and is planning on taking advantage of the tax savings.

To learn more about Shane Becker’s experience with RapidPakRx, watch his full testimonial below.

If you would like to learn more about the RapidPakRx call (877) 797-2332 to speak with an adherence expert, or visit our product page.

.png)