Do you know about "bonus" depreciation?

Investing in capital equipment can impact the success of a pharmacy. Some independent pharmacy owners have learned from experience how tremendously valuable it can be to invest in automation to help grow their businesses. So, why are so many independent pharmacy owners reluctant to make the purchase?

With DIR fees, lower reimbursements, and increased competition from national chains and online retail giants, many pharmacy owners feel that owning automation is financially unattainable. Thankfully, Section 168(k) can help offset the cost of purchasing equipment.

/Taxes%20Concept%20on%20File%20Label%20in%20Multicolor%20Card%20Index.%20Closeup%20View.%20Selective%20Focus..jpeg?width=1000&name=Taxes%20Concept%20on%20File%20Label%20in%20Multicolor%20Card%20Index.%20Closeup%20View.%20Selective%20Focus..jpeg)

What is Section 168(k)?

IRS Section 168(k) was created to help small business owners afford capital equipment. The tax code helps by allowing a depreciation deduction for the year the equipment was placed into the business, and provides a 100% depreciation bonus. This covers equipment purchased after Sept. 27, 2017. In addition, there are a few requirements that should be met prior to qualifying for the tax code. These criteria are listed below.

- Which equipment is covered? There are specific requirements that need to be satisfied in order to qualify for the tax code. For example, the recovery period of the property cannot exceed 20 years. Additionally the equipment has to be new to the owner, and if purchasing a used product, it cannot be obtained from a related party.

- Does the equipment need to be new? As mentioned before, the equipment can still qualify even if it is not brand new. This means that as long as the equipment is new to the user, then there is still the opportunity to qualify under the tax code.

- What period does the tax code cover? The tax code covers qualifying equipment purchased after Sept. 27, 2017.

How does Section 168(k) Benefit Independent Pharmacy Owners?

Section 168(k) is different than IRS Section 179. Ollin Sykes, CPA, president of Sykes & Company, explains.

"Obviously, most folks want to take advantage, of the various depreciation and write-off methods that they have available to them," Sykes says. "If you're profitable and you use Section 179 depreciation, you can write off up to 100% of the cost of the equipment. That is, if you're profitable."

"If you're not profitable, you might consider using the Section 168(k), which also allows for very accelerated depreciation," Sykes explains. "You need to talk with your tax advisor about what might be in your best interest with respect to what's the better method."

If you believe that Section 168(k) can help your pharmacy receive a depreciation deduction, it is important to discuss if you qualify with your accountant. A CPA can help you determine if the equipment you are considering qualifies for a tax deduction.

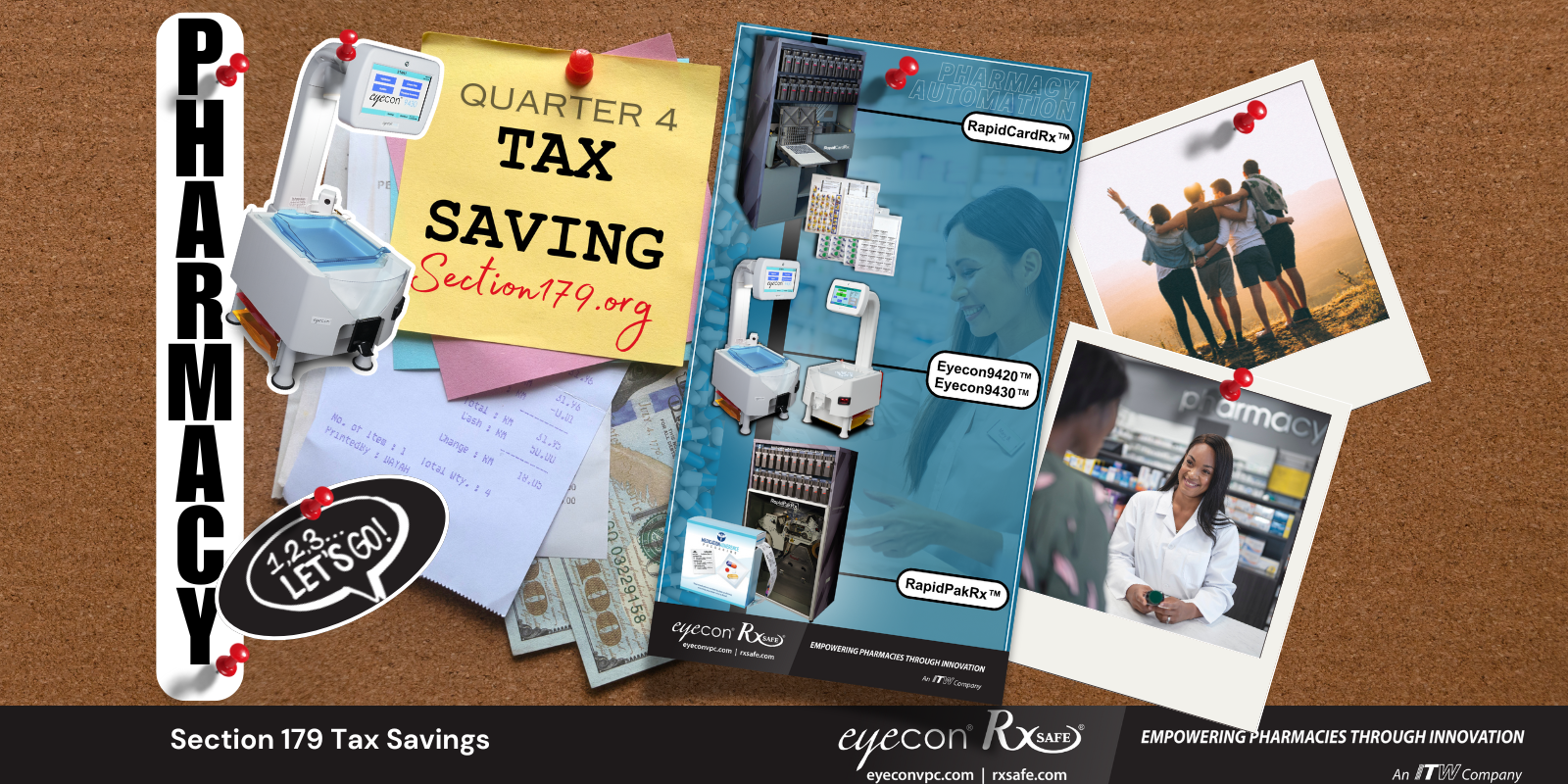

With a reduced tax load, the money saved from the depreciation deduction can be used towards paying off automation, growing your patient base, or adding profitable services with recouped staff hours. With the addition of automation such as the RapidPakRx or the RxSafe, pharmacists will experience additional benefits such as increased efficiency and accuracy, as well as peace of mind. No matter which tax code you use, Section 168(k) and Section 179 can help your pharmacy grow by providing tax relief when purchasing or leasing equipment, making automation affordable.

.png)