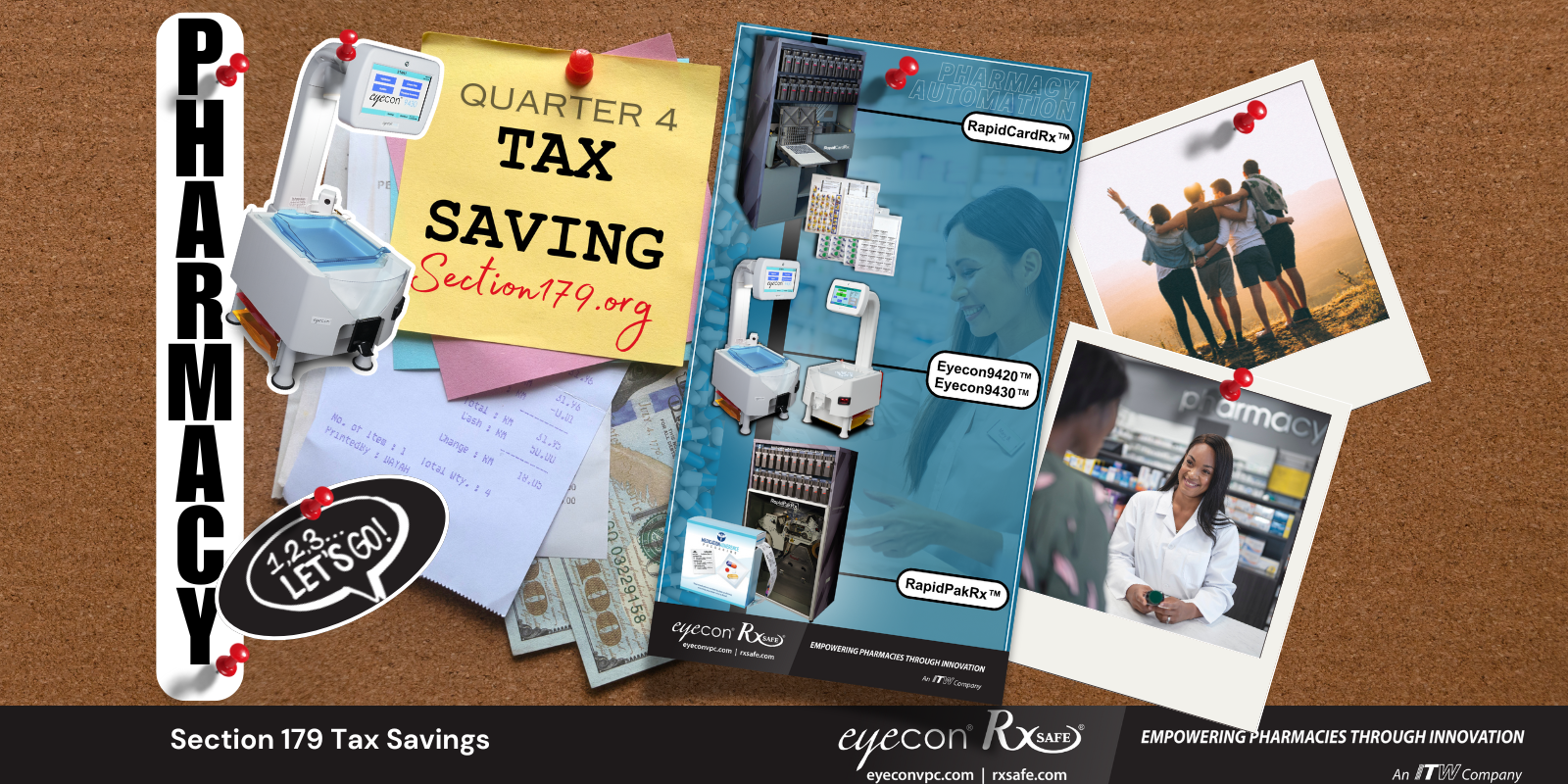

Investing in equipment can help independent pharmacy owners improve efficiency and increase profitability, yet many pharmacy owners are hesitant to make the big purchase due to financial concerns or limitations. The Section 179 deduction was created to help small business owners counteract the cost of purchasing new equipment.

Want to know more about how Section 179 can help pharmacy owners like you afford automation? In this post, we answer some of the most common questions asked about Section 179, with help from Ollin Sykes, president of Sykes & Company, a premier accounting firm for pharmacies.

How does Section 179 Benefit Pharmacy Owners?

Section 179 is a tax deduction that allows businesses to deduct the full purchase amount of qualifying equipment. For the tax year of 2019, “Section 179 allows a depreciation expense of up to and including $1,000,000 for pharmacy owners if they have income to counteract that 179 expense against,” explains Ollin Sykes, a CPA for more than 35 years. If choosing to buy equipment from RxSafe and, “say it's $175,000 and let’s say the pharmacy has $300,000 of income that year before depreciation, Section 179 will enable that equipment to be written off,” says Sykes.

/Tax%20Refund%20-%20Orange%20Button%20on%20Computer%20Keyboard.%20Internet%20Concept..jpeg?width=999&name=Tax%20Refund%20-%20Orange%20Button%20on%20Computer%20Keyboard.%20Internet%20Concept..jpeg)

For pharmacy owners hoping to expand their business and purchase equipment, the Section 179 deduction can significantly help.

“The key thing pharmacy owners need is to get with a professional who understands not only the industry, but can fundamentally help them with where they stand,” says Sykes.

Consulting with a professional helps with personal questions and can help you decide how Section 179 can help make the RxSafe or RapidPakRx affordable equipment for your pharmacy.

Section 179 Key Points

Making a capital equipment purchase requires some planning to properly qualify for the tax deduction. Here are some key points to know about the tax deduction:

- Section 179 is limited to business income

- Qualified equipment can be deducted up to $1,000,000 in 2019

- Total amount of equipment purchased is limited to $2,500,000 in 2019

- If more than $3,500,000 is purchased, the deduction is not applicable

- Equipment can be new or used, but “new to you”

- Equipment must be used within the tax year that it is being deducted from, and used more than 50% of the time.

It is also important for pharmacy owners to “know where they stand with their pharmacy, because fundamentally, if they don’t know where their net income stands for the year, then it makes it very difficult to plan for Section 179 expensing,” says Sykes. Financial data is important when making the decision to use Section 179, because it will make it easier to understand whether purchasing the equipment is the right thing to do for the current tax year, or if it should wait because it is a year with lower income. We’ll say it again: planning is critical if you’re looking to benefit from Section 179.

Should You Anticipate Changes?

Prior to 2018, the deduction amount was capped at $500,000. In January of 2018 Section 179 was changed to cap the deduction amount to $1,000,000, allowing more equipment to qualify for the tax deduction. “It’s scheduled to stay into law until 2025, and I don’t anticipate changes to hit the tax code unless there is a radical change in Congress in the next couple of years,” says Sykes

Even with the Trump administration’s latest tax reform, experts say there are not any foreseeable changes being made to Section 179.

“With Congress and Trump being in a pro-business perspective, as far as capital equipment is concerned, it has been very favorable,” explains Sykes. Sykes believes right now is a favorable time for pharmacy owners to consider Section 179 if they are considering updating their technology.

As many independent pharmacy owners know, incorporating robotics such as the RxSafe 1800 or the RapidPakRx can help them remain competitive and increase their productivity. Although there are no signs that Section 179 will experience changes, if you are interested in benefiting from the tax code, then you should not plan on putting it off longer than is necessary. The current tax code is supportive of small businesses, making it the perfect time to purchase capital equipment.

Ready to Take Advantage of Section 179?

If you have decided that Section 179 can help your pharmacy obtain the necessary equipment to grow, it is fairly easy to get started. When filing taxes, you can elect to benefit from Section 179 on your tax return form. But don’t wait until next spring.

“This is not something that pharmacy owners want to start thinking about after the fact,” explains Sykes, so before electing to benefit from Section 179, the equipment to be purchased should already be chosen, purchased and placed in service by Dec. 31, 2019, to qualify for a tax deduction this year. Even then, the decision should be discussed with a professional. If you have any further questions about Section 179, contact your accountant and find out if our products are right for your pharmacy’s financial situation.

Click here to learn more about Section 179. If you have any questions about the RxSafe 1800 or the RapidPakRx, please call (877) 797-2332 to speak to one of our automation experts.

.png)