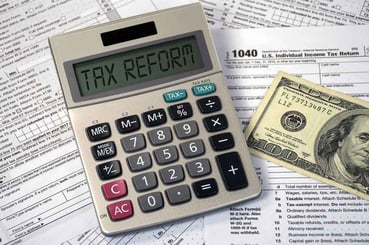

The new federal tax law, enacted by Congress and signed by President Trump last December, could have huge implications for your independent pharmacy.

Known collectively as the Tax Cuts and Jobs Act, the new regulations are the largest tax reform initiative since the Reagan administration. That means you can’t expect this year’s tax bill to remain status quo. Items you might be used to deducting may no longer be deductible. On the plus side, capital improvements that have may have seemed out of reach last year may actually help you keep some of your hard earned cash from Uncle Sam.

Known collectively as the Tax Cuts and Jobs Act, the new regulations are the largest tax reform initiative since the Reagan administration. That means you can’t expect this year’s tax bill to remain status quo. Items you might be used to deducting may no longer be deductible. On the plus side, capital improvements that have may have seemed out of reach last year may actually help you keep some of your hard earned cash from Uncle Sam.

In this blog post, we break down some of the new tax law implications, including pros and cons for pharmacy owners. First, a disclaimer: we are not certified public accountants, and nothing in this blog should be considered tax advice. Always seek professional consultation from a qualified CPA. Having said that, knowledge is power. Use this information to ask better questions when you meet with your accountant.

The good news: corporate tax rate cuts

With the Tax Cuts and Jobs Act, the tax rate for C-corporations changed from a 15%-35% rate to a flat rate of 21%. That’s the largest corporate tax reduction in US history. Since most small businesses are not set up as C-corps, you may not be affected by this. For non C-corp entities (aka pass-through entities), such as S-corporations, Sole Proprietorships, and LLCs, you may be able to qualify for a 20% income tax reduction.

To qualify, you must have a taxable income below $157,000 if you’re single—or $315,000 if married and filing jointly. If you qualify, the deduction will be applied to either your qualified business income, or your taxable income minus capital gains (whichever is lower).

Capital equipment is still a good buy

IRS Section 179, a tax benefit that provides up to $1,000,000/year of accelerated depreciation as of January 2, 2018, is still in full effect under Trump’s new tax law. At RxSafe, we know hundreds of pharmacy owners who’ve used this deduction to save tens of thousands of dollars on taxes to offset the cost of capital equipment. Visit our Section 179 page to learn more.

Another change: small businesses are now eligible for a tax credit for providing paid family and medical leave to employees—an expense that previously only large businesses were typically able to afford. Depending on what you pay for leave, your business may be eligible for a 12.5%-25% tax credit—which makes a big difference at the end of the year.

Trouble ahead? Downsides of new tax law

The new tax law isn’t all rainbows and unicorns for pharmacy owners. For example, the Qualified Business Income Deduction proposed rule would expand the "specified service trade or business," or SSTB, definition of "services performed in the field of health" to include pharmacists. Currently, that definition applies to professionals such as doctors and dentists, but not pharmacists. Altering the definition may keep some pharmacy owners from receiving the pass-through deduction, as any health care professional under the SSTB definition would not receive it unless an exemption applies. Groups such as the National Community Pharmacists Association (NCPA) are arguing against changing the SSTB definition.

"The inclusion of pharmacists in the Proposed Rule ... is overly broad and presents some factual distinctions that are necessary for appropriate application of the pass-through deduction," the NCPA wrote in an Oct. 3 letter to Treasury Secretary Mnuchin. NCPA is asking the Treasury Department to clarify regulations for the Qualified Business Income Deduction, or pass-through deduction, specifically related to community pharmacists' right to obtain the pass-through deduction.

Wait… you can’t deduct that anymore

The Tax Cuts and Jobs Act also limits or even eliminates some deductions that small business owners have been able to make in the past. Deductions that have been limited include:

- Business interest deductions (once 100% deductible, now only 30% deductible)

- IRA contribution deductions

- Deductions for providing employee meals (once 100% deductible, this is now only 50% deductible)

Deductions that have been eliminated completely include:

- Deductions for providing employee transportation

- Investment tax credit

- Deductions for entertainment expenses for clients

Measures you can take before year-end

With the lowest small business tax rates since WWII, now is a great time to take stock in your pharmacy. You have the opportunity to dramatically improve your savings, and avoid sending thousands of dollars to Uncle Sam.

Here are some to-do items:

- Talk to your CPA – Your accountant has been studying the new law’s implications for the past 11 months. Find out what it means for you!

- Invest in employees – Consider adding paid leave for family events as a way to reward your staff, while saving money on taxes.

- Upgrade equipment – Remember, you can write off 100% of the value of leased or purchased capital equipment in the first year!

- Grow your business – Think about starting an adherence program at your pharmacy. Look into BlistAssist (blister card automation) or the RapidPakRx (adherence strip packager) as a way to improve patient care and your bottom line.

Interested in learning more? Visit our Section 179 page or call now at 877-797-2332.

.png)