As the end of the 4th quarter approaches, businesses are looking to finish the year strong. Pharmacy financial expert Pete Davison of Advantage Financial Services, who has been working with RxSafe and helping independent pharmacies for nearly a decade, explains what business owners need to do.

“It's that time of year when we have to start thinking about tax planning year-end strategies, and what we need to accomplish between now and December 31st, [the] end of most people’s fiscal year,” Davison explains.

“One topic that comes up for us in the equipment financing business on a regular basis is strategies for Section 179 and accelerated depreciation, and also bonus depreciation, Section 168,” Davison continues.

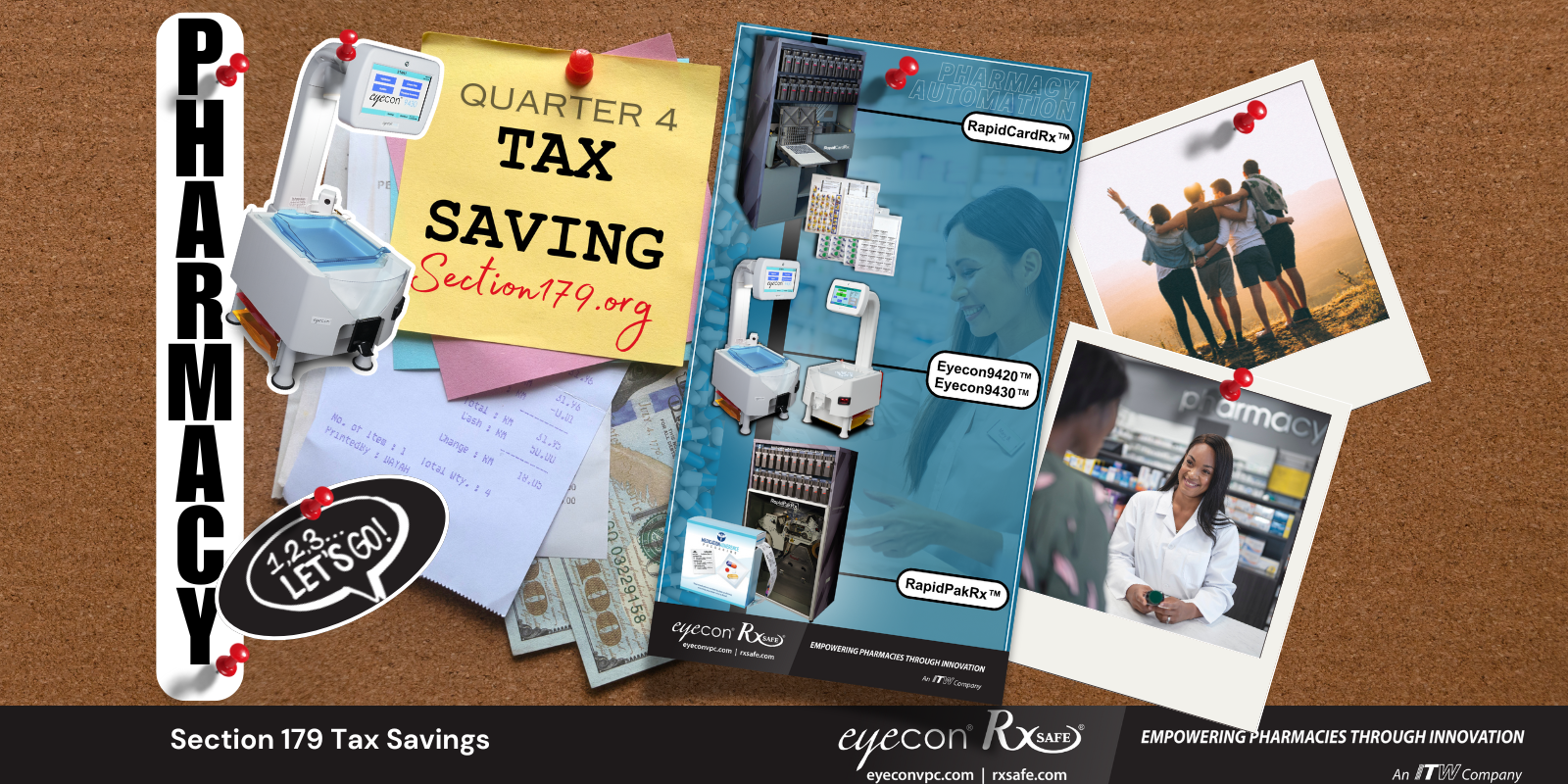

Click the image above to watch the video.

Section 179 vs Section 168: What’s the Difference?

As we’ve discussed in earlier blog posts, IRS Sec. 179 provides major benefits to businesses and individuals buying capital equipment. The tax deduction limit for new and used equipment for 2021 is $1,050,000. To use the deduction for tax year 2021, the equipment must be bought, installed, and be in use before Dec. 31, 2021.

IRS Section 168 provides 100% bonus depreciation for purchased or leased new equipment that exceeds the limit of the Section 179 spending limit of $1,050,000.

“When it comes to Section 179 and 168, there are many businesses across the country that will use those strategies to defer federal income tax by investing in technology and equipment during the remainder of this year, instead of waiting until next year. And that way you can reduce your income, hence reducing your income tax and your quarterly estimates for the future,” Davison says.

How Do Use Section 179 and Bonus Depreciation?

“Section 179 and Section 168 can be used in conjunction, or independently,” says Davison.

“Section 168 is currently on track to allow unlimited depreciation, but it will start getting phased out starting in 2023 at 20% a year. Section 179 is still a little over a million dollars and gives ample opportunity for you to invest in technology equipment, personal property, everything from potentially automobiles to automation to improve the efficiency of your business,” Davison adds.

As an example, Davison says that with a $200,000 solution at a 25% tax bracket, you could end up with a $50,000 tax savings by reducing your income by $200,000, whether it be Section 179 or [Sec.] 168.

In the current climate of uncertainty, with the pandemic still affecting business and the problem of supply chain management becoming a reality, Davison advises business owners to “take a look at what their plans are.”

“Especially this year 2021, you may need to act sooner rather than later as supply chain issues are causing some issues,” he cautions.

Work with your suppliers and vendors and with your accountants now to see what's available to you to leverage these programs and what makes the most sense.

“There are programs from finance companies out there that will potentially allow you to get all the benefits of ownership and potentially even defer payments as much as two, three, sometimes even six months,” Davison concludes.

Use our Sec. 179 calculator or download more information about the program here. You can reach out to RxSafe directly at 877-797-2332 to discuss your options and close the fiscal year with an eye for tax savings and improving your pharmacy’s profitability at the same time.

.png)