This morning, RxSafe Founder and CEO William Holmes honored two pharmacy professionals with the company's inaugural "Award of Excellence."

RxSafe

Recent Posts

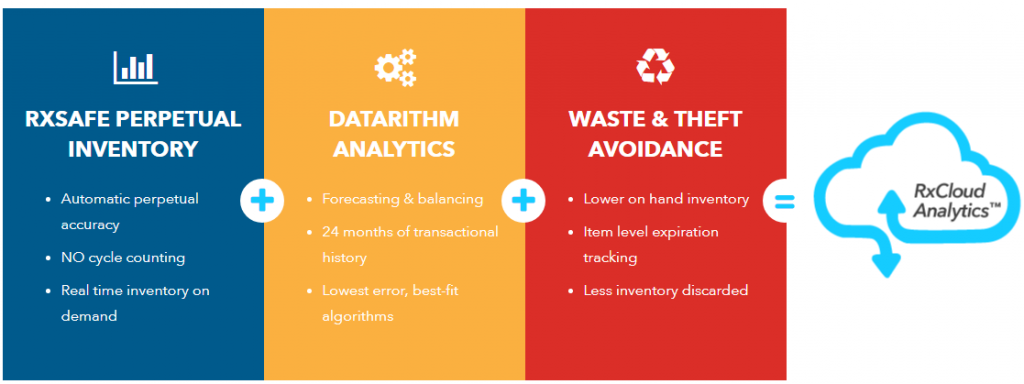

RxCloud Analytics™ is the latest innovation for our line of pharmacy automation technology. Powered by Datarithm, it will provide independent pharmacy…

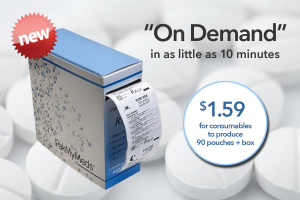

RxSafe today announced a revolutionary new adherence packaging system. RapidPakRx™ is designed to help retail pharmacies do more, including:

Short answer: Yes, if your pharmacy is equipped with the RxSafe 1800™.

RxSafe offers many ways to expand your independent pharmacy’s geographic reach and grow your customer base. One of those ways is utilizing the many…

Kevin Faust is one of hundreds of satisfied customers in the RxSafe family. He has owned and operated J&M Pharmacy in Oneonta, Alabama for eight years.…

RxSafe is thrilled to be a featured event sponsor at the annual PDS Super-Conference on Feb. 22-24, 2018, in Orlando, Florida. One of the many ways we…

When The Medicine Shoppe in Sherman, Texas began experiencing the growth that most pharmacies want, owner Jana Bennett began looking into pharmacy…

No, Amazon has not made an “official” announcement that they are entering the mail-order-drug or PBM market. However, it has been widely reported that…

IRS Code Section 179 is a bird in the hand until December 31, 2017.

Update: The passage of The Tax Cuts and Jobs Act (H.R.1 - 115th Congress) increased…

.png)